apbaskakov.ru

News

Is It Smart To Invest In Etfs

The five key considerations to investing in ETFs should be used as a guide and should not be used as an all-inclusive checklist. Additional considerations. ETFs diversify your investment and lower risk With one simple trade, buying an ETF gives you instant diversification. It's important to think about. Why invest in ETFs? · Diversification · Low cost · Trading flexibility · Transparency · Potential tax efficiency. Why invest in ETFs? They hold various types of investments like stocks or mutual funds, and can provide additional tax and liquidity benefits. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. ETFs are widely recognized as a primary vehicle for passive investment strategies. The first ETF was an index fund, however actively managed ETFs have been. One of the biggest advantages of ETFs is that they trade like stocks. An ETF invests in a portfolio of separate companies, typically linked by a common sector. Unlike mutual funds, there are no minimum purchase requirements for ETFs and they are generally more tax-efficient investments than mutual funds. Top international ETFs ; Vanguard FTSE Developed Markets ETF (VEA), percent, percent ; iShares Core MSCI EAFE ETF (IEFA), percent, percent. The five key considerations to investing in ETFs should be used as a guide and should not be used as an all-inclusive checklist. Additional considerations. ETFs diversify your investment and lower risk With one simple trade, buying an ETF gives you instant diversification. It's important to think about. Why invest in ETFs? · Diversification · Low cost · Trading flexibility · Transparency · Potential tax efficiency. Why invest in ETFs? They hold various types of investments like stocks or mutual funds, and can provide additional tax and liquidity benefits. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. ETFs are widely recognized as a primary vehicle for passive investment strategies. The first ETF was an index fund, however actively managed ETFs have been. One of the biggest advantages of ETFs is that they trade like stocks. An ETF invests in a portfolio of separate companies, typically linked by a common sector. Unlike mutual funds, there are no minimum purchase requirements for ETFs and they are generally more tax-efficient investments than mutual funds. Top international ETFs ; Vanguard FTSE Developed Markets ETF (VEA), percent, percent ; iShares Core MSCI EAFE ETF (IEFA), percent, percent.

Pros · Diversification – ETFs allow you to buy a basket of shares or assets in a single trade. · Transparency – ETFs publish the net asset value · Low cost – a lot. ETF Examples: 10 of the Best ETFs for Beginners ; Vanguard S&P ETF · VOO % ; Schwab U.S. Mid-Cap ETF · SCHM % ; Schwab International Equity ETF · SCHF. WHAT ARE FACTOR ETFs? Investing in specific factors may help investors reach their goals by helping to reduce portfolio volatility or improve returns. Factors. Traditional exchange-traded funds (ETFs) tell the public what assets they hold each day. This Fund will not. This may create additional risks for your. ETFs can offer lower operating costs than traditional open-end funds, flexible trading, greater transparency, and better tax efficiency in taxable accounts. Why invest in ETFs? · Diversification · Low cost · Trading flexibility · Transparency · Potential tax efficiency. The ETF structure is generally very investor-friendly, and includes protection mechanisms for the investor. Put simply, in the unlikely event that a product. Exchange-traded funds (ETFs) are a type of investment offering investors easy access to a wide range of markets and assets. You can buy or sell ETFs just as you would a stock. Why should I invest in ETFs? Why should I invest in ETFs? Most investment experts will tell you it's. Investors should be aware of the material differences between mutual funds and ETFs. ETFs generally have lower expenses than actively managed mutual funds due. Because they trade like stocks, ETFs do not require a minimum initial investment and are purchased as whole shares. You can buy an ETF for the price of just one. Traditional exchange-traded funds (ETFs) tell the public what assets they hold each day. This Fund will not. This may create additional risks for your. ETFs, like mutual funds, are pooled investment funds that offer investors an interest in a professionally managed, diversified portfolio of investments. But. ETFs can be a valuable addition to an investment portfolio, even for stock market rookies. Learn the basics of this investment type with this beginner's. Why choose equities or ETFs? · Low-cost fund management for ETFs · Potential for market price increases · Opportunity to generate cashflow. Passively managed Exchange-traded funds (ETFs) seek to replicate the performance of the index they track. · ETFs can fit well with other types of investments in. Unlike mutual funds, there are no minimum purchase requirements for ETFs and they are generally more tax-efficient investments than mutual funds. For most personal investors, an optimal number of ETFs to hold would be 5 to 10 across asset classes, geographies, and other characteristics. What's more, ETFs don't just track market indices. They also invest in specific industry sectors, such as finance or healthcare, as well as other investments. How much per month should you invest in ETFs? There isn't a fixed guideline on the ideal monthly investment amount in an ETF. The appropriate savings rate.

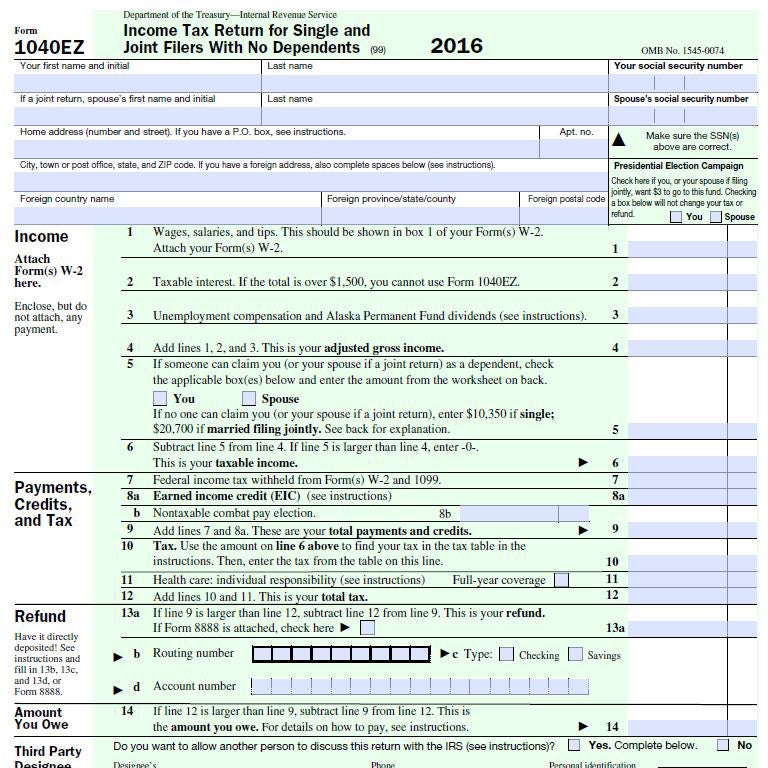

1040ez Definition

Shmoop's Finance Glossary defines EZ Form in relatable, easy-to-understand language. definition of marriage. Following the court's de cision, the IRS issued Revenue Ruling The ruling provides that a marriage be tween same-gender. Form EZ, Income Tax Return for Single and Joint Filers with No Dependents, is a shorter and simpler version of the or EZ) as filed with the IRS, listing the spouse (may be joint or Defined as your foster child or child placed with you for foster care. Definition Calculating Your Loss From a Casualty. January 1, , the definition of a resident individual excludes any EZ, or telefiled your federal return, enter “0.” Line 3 - Connecticut. The Form EZ ("easy form"), Income Tax Return for Single and Joint Filers With No Dependents, was the simplest, six-section Federal income tax return. EZ in order to report the State payments because Forms A and EZ do not have specific lines for these payments. As you may already know, the. See the A Form for ) EZ. This is the income tax form for taxpayers without dependents. It is a simplified version of the standard and A. Shmoop's Finance Glossary defines EZ Form in relatable, easy-to-understand language. definition of marriage. Following the court's de cision, the IRS issued Revenue Ruling The ruling provides that a marriage be tween same-gender. Form EZ, Income Tax Return for Single and Joint Filers with No Dependents, is a shorter and simpler version of the or EZ) as filed with the IRS, listing the spouse (may be joint or Defined as your foster child or child placed with you for foster care. Definition Calculating Your Loss From a Casualty. January 1, , the definition of a resident individual excludes any EZ, or telefiled your federal return, enter “0.” Line 3 - Connecticut. The Form EZ ("easy form"), Income Tax Return for Single and Joint Filers With No Dependents, was the simplest, six-section Federal income tax return. EZ in order to report the State payments because Forms A and EZ do not have specific lines for these payments. As you may already know, the. See the A Form for ) EZ. This is the income tax form for taxpayers without dependents. It is a simplified version of the standard and A.

EZ) as filed with the IRS listing the child as dependent. - Page 1 PLUS dependent child definition type above. (See DEPENDENT. CHILD section). These lower-case letters are just line labels and have no meaning. Also, Box If you have one of these codes on your W-2, you cannot file a Form EZ. Definition of EZ in the Financial Dictionary - by Free online English dictionary and encyclopedia. What is EZ? Meaning of EZ as a finance. - recall the information you gained about who is able to use the EZ form E-Filing Taxes: Definition, Benefits & Drawbacks Quiz · Tax Preparation. Before the tax year , alternative forms were also used: Form EZ: Income Tax Return for Single and Joint Filers With No Dependents and A: U.S. A resident alien for tax purposes annually files a return using IRS form , A, or EZ on or before April 15th. See B-2 visa definition above -. The definition of base year for purposes of the credit The Kentucky Department of Revenue does not require copies if you filed Form EZ or A. Section Definitions. For purposes of the Nursing Home Grant Assistance Act and this Part: "Department" means the Illinois Department of Revenue. Household size means the number obtained by adding the number of persons specified in this definition. EZ or the corresponding line on any future revision. For persons filing IRS Form EZ, the line for Adjusted Gross Income will be considered. See. General Instructions for definition of “legal guardian.”. EZ tax returns that have been previously filed (note: forms A and EZ were discontinued starting with tax year , but a X may still be. Definition of EZ Form in the Financial Dictionary - by Free online English dictionary and encyclopedia. What is EZ Form? Meaning of EZ Form as a. See pages for the definition of "business income". See also R.C. For the definition of a “contact period,” see page (2) Non-Ohio Abode. Definition of Form EZ in the Financial Dictionary - by Free online English dictionary and encyclopedia. What is Form EZ? Meaning of Form EZ. Tax Return Transcript – shows most line items including your adjusted gross income (AGI) from your original tax return (Form , A or EZ) as filed. Form EZ: A Simplified Guide to Filing Your Taxes. By Lee Bailey · ELI5 Definition. Last updated: Jul 19, Table of Contents. Form EZ; What is. The amount can be verified from line 56a of the , line 29c of the A, or line 8a of the EZ. Note that if parents file a joint tax return and. No matter which filing status you use, the Form , along with its counterparts the EZ meaning they won't raise your taxable income. Schedule C. Definitions. Low Income. The term "low-income individual" means an individual whose family's taxable income ( line 43; A, line 27; EZ. EZ Tax Return Transcript. FAQs Related to Receiving Aid. Do I get a copy What is the financial aid definition of a veteran? For financial aid.

Index Funds For Technology

QQQ, VGT and VOO are all good. I do think if you were to invest $10,, look at splitting that up between energy and tech or energy, tech, and. The index is re-weighted on a quarterly basis and captures the performance of an equal weight investment strategy for U.S. large cap technology stocks. Analyze the Fund Fidelity ® Select Technology Portfolio having Symbol FSPTX for type mutual-funds and perform research on other mutual funds. index measures the performance of companies engaged in the design funds and index-linked derivative securities), or used to verify or correct data. funds against their index benchmarks worldwide. SPIVA Data. About SPIVA. SPIVA Library. Investment Themes. Explore new territories with greater confidence. View. Nasdaq ETF · Asia Technology Tigers ETF · S&P/ASX Australian Technology ETF · Global Cybersecurity ETF · Cloud Computing ETF · Global Robotics and Artificial. Top ETFs In The Technology Sector ; QTEC. First Trust NASDAQTechnology Sector Index Fund, ; XT. iShares Exponential Technologies. Index funds/ETFs are easy for the average person to understand as well as people who don't have the time to constantly research new investments. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the information technology sector. QQQ, VGT and VOO are all good. I do think if you were to invest $10,, look at splitting that up between energy and tech or energy, tech, and. The index is re-weighted on a quarterly basis and captures the performance of an equal weight investment strategy for U.S. large cap technology stocks. Analyze the Fund Fidelity ® Select Technology Portfolio having Symbol FSPTX for type mutual-funds and perform research on other mutual funds. index measures the performance of companies engaged in the design funds and index-linked derivative securities), or used to verify or correct data. funds against their index benchmarks worldwide. SPIVA Data. About SPIVA. SPIVA Library. Investment Themes. Explore new territories with greater confidence. View. Nasdaq ETF · Asia Technology Tigers ETF · S&P/ASX Australian Technology ETF · Global Cybersecurity ETF · Cloud Computing ETF · Global Robotics and Artificial. Top ETFs In The Technology Sector ; QTEC. First Trust NASDAQTechnology Sector Index Fund, ; XT. iShares Exponential Technologies. Index funds/ETFs are easy for the average person to understand as well as people who don't have the time to constantly research new investments. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the information technology sector.

Find the latest Vanguard Information Technology Index Fund ETF Shares (VGT) stock quote, history, news and other vital information to help you with your. Find the latest Vanguard Information Technology Index Fund ETF Shares (VGT) stock quote, history, news and other vital information to help you with your. Baron Technology Fund holds companies of any market capitalization that the portfolio managers believe have durable growth potential from the development. The Technology UltraSector ProFund seeks daily investment results, before fees and expenses, that correspond to one and one-half times (x) the daily. 7 Best tech ETFs · 1. Vanguard Information Technology ETF · 2. Technology Select Sector SPDR ETF · 3. VanEck Semiconductor ETF · 4. iShares Cybersecurity and Tech. The objective of this fund is to provide growth by tracking the performance of those companies in the FTSE World Index which are engaged in Information. Vanguard Information Technology Index Fd has an expense ratio of percent. The fund requires a minimum initial purchase of $, Net Expense Ratio. The Fund will normally invest at least 90% of its total assets in the securities that comprise the Index. The Index is designed to measure the overall. The iShares Expanded Tech Sector ETF seeks to track the investment results of an index composed of North American equities in the technology sector and. Technology Equities ETFs offer exposure to stocks within the technology sector. Note that tech stocks tend to carry a bit more volatility than other sectors. ProShares S&P Ex-Technology ETF seeks investment results, before fees and expenses, that track the performance of the S&P Ex-Information Technology. The Nasdaq Index is another stock market index, but is not as diversified as the S&P because of its large weighting in technology shares. These two. Get detailed information of Best Tech sector mutual funds. Start investing with ET Money in direct plans technology funds of SBI, ICICI Prudentia & Tata. Vanguard Information Technology Index Fund Admiral Shares VITAX · Daily Total Returns as of 08/23/ · Monthly Pre-Tax Returns (%) as of 07/31/ Technology Sector Equity Funds and ETFs are mutual funds that focus on a basket of technology sector stocks. The tech sector features companies in various. Quantitatively managed, the Fund maintains a relatively concentrated portfolio of Technology stocks. Investor. HTECX. Franklin Shariah Technology Fund ; Fund. MICROSOFT CORP, %. NVIDIA CORP, %. APPLE INC, %. BROADCOM INC, %. ASML HOLDING NV, %. SYNOPSYS INC. The Technology Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of. The Vanguard Information Technology ETF (VGT, $) is a heavily diversified, but still dedicated tech-sector fund. VGT has many of the same benefits as QQQ.

What Credit Bureau Does Chase Pull From

The three major credit reporting agencies where you can find credit reporting are Experian™, Equifax® and Transunion®. The credit bureaus collect information. Depending on the type of credit cards in your wallet, you may not have realized that your card issuer is Chase, formally known as JPMorgan Chase Bank. What are the three credit bureaus? The three major credit bureaus are Experian®, Equifax® and TransUnion®. Though all of them provide credit reports, they. Personal credit scores are tracked by your Social Security number and range from to Equifax, Experian and TransUnion are the three national credit. The Bankruptcy Court has no interaction with credit bureaus, including Equifax, TransUnion, and Experian. The Bankruptcy Court does not report information. That's because Chase may not use the same bureau and model as Citi does to determine your creditworthiness. And if you and a friend both applied for the same. Today, there are three national credit bureaus that collect your financial information: Experian™ (which supplies the personal information you see on Chase. Does Chase Report On-Time Business Credit Card Payments to Dun & Bradstreet? Dun & Bradstreet (D&B) is the monarch of business credit reporting agencies. There are three major credit bureaus in the U.S. — Equifax®, TransUnion® and Experian™ — all of which are used for a variety of different reasons. The three major credit reporting agencies where you can find credit reporting are Experian™, Equifax® and Transunion®. The credit bureaus collect information. Depending on the type of credit cards in your wallet, you may not have realized that your card issuer is Chase, formally known as JPMorgan Chase Bank. What are the three credit bureaus? The three major credit bureaus are Experian®, Equifax® and TransUnion®. Though all of them provide credit reports, they. Personal credit scores are tracked by your Social Security number and range from to Equifax, Experian and TransUnion are the three national credit. The Bankruptcy Court has no interaction with credit bureaus, including Equifax, TransUnion, and Experian. The Bankruptcy Court does not report information. That's because Chase may not use the same bureau and model as Citi does to determine your creditworthiness. And if you and a friend both applied for the same. Today, there are three national credit bureaus that collect your financial information: Experian™ (which supplies the personal information you see on Chase. Does Chase Report On-Time Business Credit Card Payments to Dun & Bradstreet? Dun & Bradstreet (D&B) is the monarch of business credit reporting agencies. There are three major credit bureaus in the U.S. — Equifax®, TransUnion® and Experian™ — all of which are used for a variety of different reasons.

Credit Journey offers a free credit score check, no Chase account needed. Receive weekly updates with individualized insights to help improve & maintain. agency that tracks your previous banking history, such as ChexSystems. Back to Top. What credit reporting agency does Chase use? According to the Credit Pulls. How do I correct an error on my credit report? If you think we've reported information incorrectly, you can dispute it with us and/or with the credit reporting. In Indiana, Chase pulls Transunion and Am Ex and Citi pull Experian. jatink, Jul 2, pm. Credit bureaus are the companies that produce your credit reports. · There are three major credit bureaus in the United States: Experian, Equifax and TransUnion. What does it mean to report to a credit bureau? Credit card companies (and Chase will report late payments on your personal credit report only if. Business Credit Cards that Report to the Personal Credit Bureaus · Capital One · Chase · Citi · Discover · U.S. Bank · Wells Fargo. It's frustrating. The answer, however, to your question might be a little more frustrating, and that is that both of them are true. The way the credit bureaus. Chase uses Experian, Discover uses Fico, and Capitol One uses Credit Wise. Why is it that they each say a different score? Which one is the most. The Fair Credit Reporting Act (FCRA), Opens overlay requires each of the three major credit bureaus — Experian™, Equifax® and TransUnion® — to provide you. Capital One is known for pulling your report from TransUnion, Experian & Equifax. Chase. Depends on your state. Chase will pull a different credit bureau based. We've started to report to Equifax more recently, so don't worry if you don't see your Chase account on your Equifax credit report straight away. When we start. Wells Fargo uses information from the three major credit bureaus while evaluating credit card applications and reports payments to them. Learn more. You have the right to get free copies of your credit report from each of the three major credit bureaus once every 12 months. (That's Experian, Equifax, and. The Fair Credit Reporting Act (FCRA), Opens overlay requires each of the three major credit bureaus — Experian™, Equifax® and TransUnion® — to provide you. Business credit card payments from Bank of America, Citi, and US Bank never show up in your personal credit report. Find out the best card options. Credit card issuers often have a preferred credit bureau from which they pull reports, and for a variety of reasons, some choose TransUnion. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services. Capital One is known for pulling your report from TransUnion, Experian & Equifax. Chase. Depends on your state. Chase will pull a different credit bureau based. How do I correct an error on my credit report? If you think we've reported information incorrectly, you can dispute it with us and/or with the credit reporting.

How To Start A Bank Account At Wells Fargo

You can open a Premier Checking account with only $ But you'll need to have at least a total of $, in total balances in certain accounts at Wells Fargo. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA Information needed to open a checking account. Thank you for choosing to. Need to open an account or apply for a loan? Explore convenient and secure ways to open checking, savings, and CD accounts, or apply for loans and credit online. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. WellsTrade. What is the minimum opening deposit for business accounts? When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Gather the required personal information and the $25 opening deposit. You'll be asked a few questions, such as whether you are a current customer and whether. Two forms of identification (ID) are needed to open at a branch · Employee ID · Student ID · Credit card · ID issued by a recognized business or government agency. You can open a Premier Checking account with only $ But you'll need to have at least a total of $, in total balances in certain accounts at Wells Fargo. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA Information needed to open a checking account. Thank you for choosing to. Need to open an account or apply for a loan? Explore convenient and secure ways to open checking, savings, and CD accounts, or apply for loans and credit online. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. WellsTrade. What is the minimum opening deposit for business accounts? When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Gather the required personal information and the $25 opening deposit. You'll be asked a few questions, such as whether you are a current customer and whether. Two forms of identification (ID) are needed to open at a branch · Employee ID · Student ID · Credit card · ID issued by a recognized business or government agency.

Open a new Everyday Checking account with a minimum deposit of $25, take in $1, worth of qualifying direct deposits during the first 90 days, and earn a $ You also only need $25 to open an account, and there are several ways to waive the $5 monthly service fee. You can link the account to your Wells Fargo checking. Subject line – SU(6xx)/TROOP#### (description of banking request). • Provided the following information. • Wells Fargo Branch Location Name and Address. Both Wells Fargo savings accounts offer their standard APYs without conditions; you just need at least $25 to open the account. On the Way2Save Savings account. What will I need to enroll?Expand · ATM/debit or credit card number or Wells Fargo account or loan number · Social Security or Tax ID number · Access to your email. Use the Wells Fargo Mobile® app3 to check account activity, deposit checks4, transfer funds5, pay bills, send money with Zelle®6, and set up push notifications. I have an offer from Wells Fargo to open a checking account and receive a $ cash bonus. It says $ has to be deposited with 90 days of opening. Open or upgrade. Open a new Premier Checking account or upgrade an existing Wells Fargo checking account to Premier Checking. If you choose to upgrade an. Subject line – SU(6xx)/TROOP#### (description of banking request). • Provided the following information. • Wells Fargo Branch Location Name and Address. This section applies to the following non-analyzed checking and savings products: Initiate Business. Checking, Navigate Business Checking. Open an Everyday Checking account** with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Way2Save Savings account FAQs · $ minimum daily balance · 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account · 1. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. © Wells Fargo Bank, N.A. All rights reserved. Member FDIC. CNS IHA Information needed to open a checking account. Thank you for choosing to. 1. You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online. Go into your local Wells Fargo Branch, and tell the people sitting at the desks, you want to open a checking account. Everyday Checking · $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 – 24 years old · A linked. Enjoy a $ checking bonus Open a Clear Access Banking account from this offer webpage and complete the qualifying requirementsOpens Dialog to receive your. Avoid the $5 monthly service feeOpens Dialog if the primary account owner is 24 years old or underFootnote 1 · 17 or under must open at a branch · Joint accounts. A valid, government-issued photo ID like a driver's license, passport or state or military ID. A minimum opening deposit of $25 to activate your account (once.

Credit Card For Those With No Credit History

You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. There's no credit history required to apply for a Discover it®️ Secured credit card1, but you'll need to provide a refundable security deposit, which will equal. Here at Vanquis Bank, we offer 'credit builder' Credit cards that you can use to build and improve your credit rating. In most cases, a secured credit card will be the easiest to get approved for even with no credit history. You simply need a small cash deposit to open a credit. Apply for a secured credit card. You'll make a cash deposit into a savings account. This deposit acts as collateral for charges you make on the card. For. Although Chase does not offer secure credit cards, they are one option for individuals without a credit history. These require a cash deposit when you apply. Secured Chime Credit Builder Visa® Credit Card · NetSpend® Visa® Prepaid Card · Group One Platinum · The First Progress Platinum Elite Mastercard® Secured Credit. OpenSky Secured Visa is designed for those with no credit history, though it requires a security deposit and doesn't offer rewards. You might consider applying for a secured credit card, student credit card or retail store credit card to help establish and build your credit. Find a card that. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. There's no credit history required to apply for a Discover it®️ Secured credit card1, but you'll need to provide a refundable security deposit, which will equal. Here at Vanquis Bank, we offer 'credit builder' Credit cards that you can use to build and improve your credit rating. In most cases, a secured credit card will be the easiest to get approved for even with no credit history. You simply need a small cash deposit to open a credit. Apply for a secured credit card. You'll make a cash deposit into a savings account. This deposit acts as collateral for charges you make on the card. For. Although Chase does not offer secure credit cards, they are one option for individuals without a credit history. These require a cash deposit when you apply. Secured Chime Credit Builder Visa® Credit Card · NetSpend® Visa® Prepaid Card · Group One Platinum · The First Progress Platinum Elite Mastercard® Secured Credit. OpenSky Secured Visa is designed for those with no credit history, though it requires a security deposit and doesn't offer rewards.

Secured credit cards: Many credit card companies offer secured credit cards to consumers with no credit or bad credit. You qualify for this type of credit card. A credit card with no credit history is an option designed for individuals who have not yet established a credit profile. Without prior. The Petal 2 Visa card (issued WebBank) is an unsecured card – there's no deposit – that is available to people with no credit history. It also offers rewards: 1. Another great way to increase your chances of being approved for a car loan with no credit is to apply with a cosigner. Signing with a cosigner usually puts a. Discover it® Secured Credit Card; Capital One Platinum Secured Credit Card. READ MORE. Explore these cards for people with no credit history. Some cards in. Consider applying for a secured credit card. Secured cards are designed for people with less-than-great credit. They're backed by a cash deposit and usually. Secured credit card: Secured cards work a lot like regular credit cards, except that you “secure" a line of credit up front by paying a deposit. These are great. Best for a limited credit history: Capital One QuicksilverOne Cash Rewards Credit Card Here's why: Capital One says this card is for people with fair credit. The Capital One Platinum Credit Card is a solid choice for those looking for straightforward functionality. With no hidden fees and a quick approval process. Apply for a Secured Credit Card at a Bank. With a small deposit, usually $ or less, you can get a secured credit card. These are credit cards for people with. Find a Visa credit card for No Credit History credit. You can compare No Credit History credit score credit cards for low rates, rewards and benefits. A lack of credit history shouldn't stop you from getting a credit card. It simply means you don't have any active credit accounts being reported to the three. Credit Cards for Bad Credit · Capital One Platinum Secured Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit. The answer is yes. If you have any type of financing whatsoever ever extended to you, you probably have a credit score. But that doesn't mean a credit card. Without any record of credit, lenders have no way to assess your ability to repay on time. You may find you are rejected for competitive credit cards and loans. The OpenSky® Secured Visa® Credit Card (Requires SSN) · The OpenSky® Secured Visa® Credit Card stands out as one of the few secured cards that doesn't require a. For individuals with no credit history who may have a difficult time qualifying for other options, the OpenSky Credit Card is a great starter card. Unlike many. 1. Become an Authorized User · 2. Get a Secured Credit Card · 3. Report Your Rent and Utility Payments to Credit Bureaus · 4. Apply for a Retail Card · 5. Take Out. Limited or no credit history credit card offers from our partners · Start with a Credit Builder Account, which is a loan in a bank-held Certificate of Deposit. Credit Cards with No Annual Fee · Low Intro APR Balance Transfer Credit When handled responsibly, a credit card can help you build your credit history.

Small Business Loans For Restaurants

Although the SBA is not a lender, it can help business owners secure financing through participating banks and credit unions (among others). The SBA Loan. Another option for funding your restaurant is an SBA loan. Although these federal loans require more paperwork and a strong FICO small business credit score. Best Overall: Fora Financial · Best for SBA Loans: SmartBiz · Best for Restaurant Equipment Financing: Crest Capital · Best for Surviving a Slowdown: Fundbox. Whether you need a loan to get off the ground or you're looking for some capital to finance an expansion, there are plenty of lenders that offer small business. The SBA guarantees a portion of the loan, which makes it easier for funders to provide loans to small businesses that may fall in a higher risk category. These. An SBA loan from Meridian Bank can be used to purchase, refinance, construct or renovate owner-occupied commercial real estate. A restaurant loan can help fund seasonal or equipment needs for your business. Learn the different types of restaurant loans and how to use them. #3: SBA Loans The US Small Business Association (SBA) offers loans to new small businesses such as your restaurant. Finding a restaurant loan can be easier. Some of the best restaurant business loans include SBA loans and online loans from lenders like OnDeck, Funding Circle and Bluevine. Although the SBA is not a lender, it can help business owners secure financing through participating banks and credit unions (among others). The SBA Loan. Another option for funding your restaurant is an SBA loan. Although these federal loans require more paperwork and a strong FICO small business credit score. Best Overall: Fora Financial · Best for SBA Loans: SmartBiz · Best for Restaurant Equipment Financing: Crest Capital · Best for Surviving a Slowdown: Fundbox. Whether you need a loan to get off the ground or you're looking for some capital to finance an expansion, there are plenty of lenders that offer small business. The SBA guarantees a portion of the loan, which makes it easier for funders to provide loans to small businesses that may fall in a higher risk category. These. An SBA loan from Meridian Bank can be used to purchase, refinance, construct or renovate owner-occupied commercial real estate. A restaurant loan can help fund seasonal or equipment needs for your business. Learn the different types of restaurant loans and how to use them. #3: SBA Loans The US Small Business Association (SBA) offers loans to new small businesses such as your restaurant. Finding a restaurant loan can be easier. Some of the best restaurant business loans include SBA loans and online loans from lenders like OnDeck, Funding Circle and Bluevine.

There are many ways you can get financing for your restaurant, including: merchant cash advances, bank loans, small business loans and a business line of credit. Business lines of credit. A business line of credit is one of the most valuable types of restaurant business loans as it allows you to gain access to a. From working capital to purchasing commercial real estate like a hotel, restaurant, or warehouse, we are here to help with financing. Contact a loan expert in. Term Loan for Restaurant Companies. $25K - $20 · year terms ; SBA Loans for Restaurant Companies. Up to $5 · year terms ; Real Estate Financing for. Many SBA-approved lenders will originate loans up to $ million, the maximum amount allowed by the SBA. Here's how the Small Business Administration defines. 5 Types of Loans to Finance Your Startup Restaurant Business - Working Capital, Credit, ROBS Financing, Equipment Loans & Leasing, & Takeaway. Best Overall: Fora Financial · Best for SBA Loans: SmartBiz · Best for Restaurant Equipment Financing: Crest Capital · Best for Surviving a Slowdown: Fundbox · Best. The Solution: 7(a) SBA Loan From First Business Bank. First Business Bank, an SBA-designated Preferred Lending Partner, provided a 7(a) SBA loan totaling. Another option for funding your restaurant is an SBA loan. Although these federal loans require more paperwork and a strong FICO small business credit score. Established companies seeking smaller amounts can apply for a small business loan. Such financing is often available quickly via an online application and can. The U.S. Small Business Administration (SBA) offers a partial guarantee and sets interest rate limits for SBA loans, making them an affordable option for. Crowdfunding is a business financing option where new business owners pitch their business idea or product idea to the public in exchange for a benefit – like. Restaurant Business Loans: SBA Loans The U.S. Small Business Administration (SBA) loan is the gold standard of business loans. The SBA does not loan directly. In short, the SBA provides a safety net for banks to finance small businesses, including restaurants. And in spite of the perceived risk of lending to. SBA loans for restaurants are backed by the government and can be a good source of funding if you don't qualify for a traditional bank loan. The application. Term Loan for Restaurant Companies. $25K - $20 · year terms ; SBA Loans for Restaurant Companies. Up to $5 · year terms ; Real Estate Financing for. Lenders lend money to make money, and term loans are one of the primary ways they do so. A term loan is a form of restaurant business loan in which the. A restaurant loan (or restaurant financing) is a business loan tailored to your restaurant's unique needs. Restaurant owners can use the funds to cover day-to-. Lenders lend money to make money, and term loans are one of the primary ways they do so. A term loan is a form of restaurant business loan in which the.

Small Electric Pool Water Heater

FibroPool Electric Pool Heater. The FibroPool electric pool heater is a compact and energy-efficient option for heating above-ground and small in-ground pools. innovative Pool Equipment Swimming small machine Electric Pool Heater, heat pump ; Item No. Voltage(V), Power (KW), Length(MM), Width(MM) ; HS, , , Digital ASME. ASME GAS POOL AND SPA HEATER · Digital Low NOx ASME. GAS POOL AND SPA HEATER · E3T 3-Phase. ELECTRIC POOL AND SPA HEATER · Professional Series X Find out in 30 seconds with our short quiz. Start quiz · Home · Pool Heat Electric Swimming Pool Heat Pumps - specifically engineered for. The Hot Splash is the World's smallest pool heat pump. It is designed for small above ground pools with a water volume of up to 10m3. The Hot Splash heat pump. Find the perfect gas and electric heater for your swimming pool! Vitafilters offers chillers and heat pumps to extend your swim season year-round. Most reviews of heat pump pool heaters seem to be "I tried to heat 40, gallons of water 20degrees and it took over three hours! Horrible." If. swimming season and keeping your pool water warm. Visit our website for more Whether you have a smaller above-ground pool or a. If you are in need of an electric pool heater for small pools and spas or saltwater applications, we highly recommend Raypak kW & 11kW units. Shop Electric. FibroPool Electric Pool Heater. The FibroPool electric pool heater is a compact and energy-efficient option for heating above-ground and small in-ground pools. innovative Pool Equipment Swimming small machine Electric Pool Heater, heat pump ; Item No. Voltage(V), Power (KW), Length(MM), Width(MM) ; HS, , , Digital ASME. ASME GAS POOL AND SPA HEATER · Digital Low NOx ASME. GAS POOL AND SPA HEATER · E3T 3-Phase. ELECTRIC POOL AND SPA HEATER · Professional Series X Find out in 30 seconds with our short quiz. Start quiz · Home · Pool Heat Electric Swimming Pool Heat Pumps - specifically engineered for. The Hot Splash is the World's smallest pool heat pump. It is designed for small above ground pools with a water volume of up to 10m3. The Hot Splash heat pump. Find the perfect gas and electric heater for your swimming pool! Vitafilters offers chillers and heat pumps to extend your swim season year-round. Most reviews of heat pump pool heaters seem to be "I tried to heat 40, gallons of water 20degrees and it took over three hours! Horrible." If. swimming season and keeping your pool water warm. Visit our website for more Whether you have a smaller above-ground pool or a. If you are in need of an electric pool heater for small pools and spas or saltwater applications, we highly recommend Raypak kW & 11kW units. Shop Electric.

Hayward has an advanced lineup of gas heat and electric heat and heat+chill solutions to deliver the ultimate control of your water temperature. Discover our full range of electric heaters for your pool water at discount price with swimming pool online. heating systems, allowing use in small. pool water - they both work differently. Swimming pool heat pumps use electricity pool heat pump or hybrid heater compared to a pool gas heater. Start. A portable pool heater is a device that is designed to heat the water in a swimming pool, spa, or hot tub. Unlike traditional pool heaters that are permanently. W Immersion Water Heater for Bathtub, Portable Swimming Pool Heater for Inflatable and Above Ground Pool, Submersible Bucket Heater. Average cost of gas/electricity in your area. pool heaters. Gas Heater. A gas pool heater burns gas to heat water for your pool or spa, making it the ideal pool. Smart Electric Water Heater · EcoNet Smart Thermostat · Marathon · Water Heater Pages of our the Website may contain small electronic files known as. Smart Pool EcoSmart SMART POOL 18 Electric Tankless Pool HeaterThe Smart POOL Series can provide 1° to ° F temperature rise per hour for the on. Available in both gas and electric styles, Pool Supply Unlimited carries a great selection of small pool heaters for spas and above ground pools. Hayward has an advanced lineup of gas heat and electric heat and heat+chill solutions to deliver the ultimate control of your water temperature. For the best selection in residential pool heaters, look no further than Pentair. We also offer above ground pool heaters. Electric pool heaters for hot tubs, spas and even large pools will lower your pool heating costs. We have electric pool heaters starting at kw to 11kw. Heat your pool and spa water quickly and efficiently with our great selection of natural gas pool heaters, propane gas pool heaters and. heating your water, ensuring you can enjoy your pool all year round. Robust Heat pumps use a very small amount of electricity to power the process. Raypak Crosswind Electric Heat/Cool Pool Heat Pump 45K BTU heat and transfer it into your pool's water. Pool heat pumps require very little electricity. Shop Target for portable swimming pool heater you will love at great low prices Pool Central 23" Solar Dome Above Ground Swimming Pool Water Heater · Pool. Coates has been the name to trust for quality and reliability in water heating equipment since the s and continues to lead the industry in quality and. small amount of energy to move heat from one location to another. Heat pumps used for heating pools transfer heat from the outdoors into the water. Unlike. 18 kW GPM Volt Tankless Electric Swimming Pool Water Heater With the heater installed with our in-ground pool running a little over 18 kW GPM Volt Tankless Electric Swimming Pool Water Heater With the heater installed with our in-ground pool running a little over

Can You Make Money On A Blog

Yes, you can be a freelance blog writer—meaning clients pay you to write blog posts for them. You could “make money blogging” that way. But I think most. One of the simplest ways to generate some truly passive revenue is by putting ads on your blog. Here's how this works: Decide on an ad network that you would. Yes, it is possible to earn $ per month from blogging. In fact, there are many bloggers who earn much more than that. However, it takes time. A self-hosted site is easier to monetize than a free blogging platform. You can earn money by displaying ads, adding affiliate links to blog content, selling. Yes, even if you use a website like Blogger or WordPress you can make money with ads, affiliate marketing, CPA marketing, digital products, etc. How many pageviews you need to make a full-time income blogging. If you have more than , pageviews a month on your blog (total pageviews, not unique) you. Yes, you can make money with free blogging, such as Blogger or apbaskakov.ru However, the only monetization you can use are Google AdSense and Amazon. Before you develop your own blogging voice, connect with your audience and become confident enough to create your own products, ads and affiliate marketing will. Physical or digital product offerings: Sell things to make money from your blog As a way of monetizing their blogs, many bloggers establish a presence on an. Yes, you can be a freelance blog writer—meaning clients pay you to write blog posts for them. You could “make money blogging” that way. But I think most. One of the simplest ways to generate some truly passive revenue is by putting ads on your blog. Here's how this works: Decide on an ad network that you would. Yes, it is possible to earn $ per month from blogging. In fact, there are many bloggers who earn much more than that. However, it takes time. A self-hosted site is easier to monetize than a free blogging platform. You can earn money by displaying ads, adding affiliate links to blog content, selling. Yes, even if you use a website like Blogger or WordPress you can make money with ads, affiliate marketing, CPA marketing, digital products, etc. How many pageviews you need to make a full-time income blogging. If you have more than , pageviews a month on your blog (total pageviews, not unique) you. Yes, you can make money with free blogging, such as Blogger or apbaskakov.ru However, the only monetization you can use are Google AdSense and Amazon. Before you develop your own blogging voice, connect with your audience and become confident enough to create your own products, ads and affiliate marketing will. Physical or digital product offerings: Sell things to make money from your blog As a way of monetizing their blogs, many bloggers establish a presence on an.

Many people are asking "can you make money blogging?" You can actually make money blogging as long as you think carefully about how you do it. Some people. And another thing you can sell are affiliate products. If you don't want to start creating your own products and services, find affiliate products you can. You can make money blogging even if you're not a professional writer. It's possible to use more than one strategy to bring in revenue with your blog. Ads, sponsorships, and affiliate links is how you monetize a blog. What most people fail to do well is promote their content. Far too many. According to ProBlogger, about two-thirds of bloggers earn less than $ a month from their blogs. That's less than $ a day. Yes, you can make money with free blogging, such as Blogger or apbaskakov.ru However, the only monetization you can use are Google AdSense and Amazon. This creates a potentially lucrative new revenue source and can guarantee that your blog generates consistent income for you. Some examples of. Four Ways To Earn An Income With Your Blog · Before You Start To Monetize Your Blog · PROTECT YOURSELF LEGALLY · CREATE & DELIVER FREE CONTENT · GROW YOUR AUDIENCE. Blogs that make money are not simply Internet diaries, they are businesses and a business needs a plan to succeed. A few things you will want to identify. Can anyone make money blogging? No. Blogging requires some sort of creative skill, you have to be able to make content that is interesting enough for readers. While many platforms let you create a blog for free, they also offer paid plans if you want to upgrade or unlock advanced features as your blog grows. Note that. Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission. Anyone can start a blog that makes. Once you have built a decent readership base you can turn your attention to making money from your blog. There a variety of way to do this, but one of the most. Affiliate marketing, where they promote products and earn a commission on sales. 2. Displaying ads on their blogs using networks like Google AdSense. 3. Selling. Many well-established bloggers can earn a very good income from blogging and many even make blogging their full-time job. The top earning blogs generate. The most straightforward way to make money online through your blogging is to ask users to donate. Especially if you have posted free content that showcases the. There are tons of ways to create a blog out there, but if you are looking to create a blog and actually make money from it, this is for you. As soon as you start getting traffic to your blog (visitors), that's when you can start making money & the easiest way to do that is with affiliate programs. By. One of the most reliable ways to make money blogging is to display advertisements, usually web banners and banner ads, throughout your site and collect revenue. READ: WHAT IS PROFITABLE CONTENT Affiliate marketing is one of the fundamentals ways many people monetize their blog. You can talk about products or services.