apbaskakov.ru

Community

Earn Money Talking Online

Get paid to talk to lonely people on various platforms, earning $$20/hr. Requires being 18+, friendly, with a laptop/phone and high-speed internet. Top. If you're more confident with public speaking and have solid story-telling Also, here are the websites you should check if you decide to earn money online as. Use social media to promote your chat services. · Participate in online forums and groups related to your chat topics. · Respond promptly and. So what is Chamet? So Chamet is an online social media. private and live streaming platform to make voice. chat and video calls that will allow users. to. How to Avoid Losing Money to a Romance Scammer · Stop communicating with the person immediately. · Talk to someone you trust. · Search online for the type of job. IMPORTANT NOTICE! TOLOKA APPLICATION IS NOT DESIGNED FOR TOLOKA ANNOTATORS PLATFORM USERS. PLEASE DO NOT DOWNLOAD *** Toloka is an app for earning money. If you want to get paid to be an online friend, RentAFriend is one of the most popular websites to sign up for. FlirtBucks - Get Paid to Chat! Work from home. Set Your own hours. Meet guys in a fun and flirty atmosphere. Beermoney: Make money online. /r/Beermoney is a community for people to discuss mostly online money-making opportunities. You shouldn't. Get paid to talk to lonely people on various platforms, earning $$20/hr. Requires being 18+, friendly, with a laptop/phone and high-speed internet. Top. If you're more confident with public speaking and have solid story-telling Also, here are the websites you should check if you decide to earn money online as. Use social media to promote your chat services. · Participate in online forums and groups related to your chat topics. · Respond promptly and. So what is Chamet? So Chamet is an online social media. private and live streaming platform to make voice. chat and video calls that will allow users. to. How to Avoid Losing Money to a Romance Scammer · Stop communicating with the person immediately. · Talk to someone you trust. · Search online for the type of job. IMPORTANT NOTICE! TOLOKA APPLICATION IS NOT DESIGNED FOR TOLOKA ANNOTATORS PLATFORM USERS. PLEASE DO NOT DOWNLOAD *** Toloka is an app for earning money. If you want to get paid to be an online friend, RentAFriend is one of the most popular websites to sign up for. FlirtBucks - Get Paid to Chat! Work from home. Set Your own hours. Meet guys in a fun and flirty atmosphere. Beermoney: Make money online. /r/Beermoney is a community for people to discuss mostly online money-making opportunities. You shouldn't.

Dive into the rewarding world of earning income by talking to lonely people. This insightful article unveils various platforms where compassionate. Overall, combining these opportunities allowed me to turn my chatting skills into a steady income stream while enjoying the flexibility to work. make money chatting online#chatmoderation #chatmoderator #getpaidtochattolonelypeople · original sound - Themoneymaker❤️ · Online Chat Moderator Jobs · Website. How To Earn Money text-circle Through Chatting? · Sign up on Fahdu and become a creator to access exclusive features. · If you are already a creator, you must. Chat when, where and how much you want, and earn money for each conversation. Complete the form and get trained to attend digital customers. However, the most obvious option for many is to get a part-time job, which means more time away from home. Luckily, the robust online world has provided people. Register online at Talk Online Panel and earn points for each completed survey points can be used anytime. It is now a lucrative way to make money. With the rise of online communication platforms, there are now many opportunities to earn money simply. Register online at Talk Online Panel and earn points for each completed survey points can be used anytime. We are looking for chat support who spea Chat Support Sales Online Chat Support get paid for your work. Find work. Upwork Payment Protection Gives you. MyGirlFund: This platform lets you earn money by chatting, flirting, and sharing photos with clients who are looking for companionship. Dream. If you want to get paid to be an online friend, RentAFriend is one of the most popular websites to sign up for. You can earn up to $3 to $5 per hour to chat online. Requirement to Get Paid to Chat with Lonely People. To join these platforms where you earn. FlirtBucks allows you to earn a side income by text chatting and video chatting with people who are seeking friendship, flirting, or simply having a good. If you're more confident with public speaking and have solid story-telling Also, here are the websites you should check if you decide to earn money online as. 86 votes, comments. Has anyone found any subreddits or sites/apps to join where you can chat with people to earn money? Work from home with ChatWork. Earn money with chat messages. Register Then sign up via the website and start making money online quickly with chatting. In fact, as per recent studies using tools like Chat GPT are now becoming one of the several ways businesses make money online by managing their clients' social. You could easily get paid to chat and text online and make some extra dollars. Sign up today with any one of the above legitimate companies for free. speaking, you can expect to make $1, per month. How Old Do I Need to Be to Start Making Money Online? Most online jobs for teens require you to be at.

Foreign Brokerage

Start trading with No. 1 forex broker in the US*. Our award-winning online forex trading platforms and apps are available on web, desktop and mobile. Voted Best Low Cost Broker (ADVFN International Financial Awards ). Voted Best Forex Broker two years in a row (TradingView Broker Awards Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Investment product fees & minimums for Vanguard Brokerage Accounts. As of Foreign securities and ADR dividends. Vanguard Brokerage charges a fee of 1. Some foreign governments impose a fee on purchases and sales of securities of companies incorporated in their countries. The Foreign Financial Transaction. With offices across Canada and the U.S., Cole International provides customs brokerage and freight forwarding services to companies across North America. Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here. Foreign stocks or securities · Safe deposit box · Foreign financial institution investment account brokerage accounts held with a bank or broker-dealer. Foreign brokers that engage in securities transactions with U.S. investors based in the United States must be registered with the Securities and Exchange. Start trading with No. 1 forex broker in the US*. Our award-winning online forex trading platforms and apps are available on web, desktop and mobile. Voted Best Low Cost Broker (ADVFN International Financial Awards ). Voted Best Forex Broker two years in a row (TradingView Broker Awards Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Investment product fees & minimums for Vanguard Brokerage Accounts. As of Foreign securities and ADR dividends. Vanguard Brokerage charges a fee of 1. Some foreign governments impose a fee on purchases and sales of securities of companies incorporated in their countries. The Foreign Financial Transaction. With offices across Canada and the U.S., Cole International provides customs brokerage and freight forwarding services to companies across North America. Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here. Foreign stocks or securities · Safe deposit box · Foreign financial institution investment account brokerage accounts held with a bank or broker-dealer. Foreign brokers that engage in securities transactions with U.S. investors based in the United States must be registered with the Securities and Exchange.

I also use BoA, Etrade, HSBC and a regional credit union but IMHO Fidelity has the best investment options. As a leading Foreign Exchange Prime Broker (FXPB), BNP Paribas serves a diversified institutional client base. In August, BGC Partners acquires MINT Partners and MINT Equities. Over MINT brokers from its international business join the Company. In November, Ernst and. Lockton is the world's largest independent insurance brokerage providing customized solutions to meet your organization's risk, benefits and retirement. SAB Invest provides International brokerage services for trading in stocks, Options and Exchange Traded Funds (ETFs) in international markets which includes US. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. Additional information is available in our. International freight forwarders are agents for exporters and can move cargo from “dock-to-door,” providing several significant services: Arranging for and. A foreign broker or dealer shall be exempt from the registration requirements of sections 15(a)(1) or 15B(a)(1) of the Act to the extent that the foreign. Accordingly, the U.S. securities laws apply to foreign broker-dealers doing business in the United States. v1. Page 3. 3. Broker-Dealer Registration. IBKR Mobile For experienced traders who need the power to trade stocks, options, futures, currencies, bonds, and more across more than markets worldwide. IBBA is the world's largest community of professionals in the business brokers network and intermediary industry. Browse through our website and learn more. While FedEx international shipping services include customs brokerage, also known as FedEx Broker-Inclusive, we also give you the option to use your own broker. Ross Cameron typically trades with Lightspeed as his primary broker. He previously used Trade Ideas for scanning and eSignal but has switched to using the Day. The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States. Foreign exchange (forex or FX) trading involves buying one currency and selling another while attempting to profit from the trade. According to the latest. We are an institutional-grade financial services franchise that provides global market access, clearing and execution, trading platforms and more. The CFTC has witnessed a sharp rise in forex trading scams in recent years and wants to advise you on how to identify potential fraud. Signs of a Possible. Foreign exchange prime brokerage has typically been used by hedge funds and commodity trading advisors (CTAs). Prime brokerage allows these market. If a foreign brokerage firm has opened an account for its customers at a SIPC-member firm, and if the member firm is placed in SIPA liquidation, each of the.

State Farm Insurance Road Service

Roadside Assistance · Home & Property · Home · Condominium · Renters Insurance © Copyright , State Farm Mutual Automobile Insurance Company, Bloomington. What's changing? · 1. Call · 2. Dial 2 for Nation Safe Drivers · 3. We cover any roadside service. Emergency road service insurance can provide coverage for roadside assistance, such as towing, battery jump-starts, lockout services, and tire repair. At American Family Insurance, our 24/7 emergency roadside assistance helps pay for service and support when your car can't make it to a repair shop. Allstate Roadside offers fast and reliable roadside assistance whether you need a tow, jump start, help with a flat tire or lock-out assistance. State Farm is among those who use either Swoop or Agero (which Agero was bought out by Swoop). Whether they use them exclusively or whether they use others. State Farm Insurance is the official sponsor of the Highway Emergency Local Patrol (HELP) traveler assistance service. The funding is used. If you have a Farm Bureau Insurance® personal auto policy, get help anywhere in the United States 24/7, days a year for any of these services: Battery. Roadside assistance also covers one hour of on-scene repair work by a mechanic or a technician. It's intended for minor problems that can be fixed on the spot. Roadside Assistance · Home & Property · Home · Condominium · Renters Insurance © Copyright , State Farm Mutual Automobile Insurance Company, Bloomington. What's changing? · 1. Call · 2. Dial 2 for Nation Safe Drivers · 3. We cover any roadside service. Emergency road service insurance can provide coverage for roadside assistance, such as towing, battery jump-starts, lockout services, and tire repair. At American Family Insurance, our 24/7 emergency roadside assistance helps pay for service and support when your car can't make it to a repair shop. Allstate Roadside offers fast and reliable roadside assistance whether you need a tow, jump start, help with a flat tire or lock-out assistance. State Farm is among those who use either Swoop or Agero (which Agero was bought out by Swoop). Whether they use them exclusively or whether they use others. State Farm Insurance is the official sponsor of the Highway Emergency Local Patrol (HELP) traveler assistance service. The funding is used. If you have a Farm Bureau Insurance® personal auto policy, get help anywhere in the United States 24/7, days a year for any of these services: Battery. Roadside assistance also covers one hour of on-scene repair work by a mechanic or a technician. It's intended for minor problems that can be fixed on the spot.

Been in an accident and need roadside help? Give us a call at or view Accident Help.

With the award winning State Farm mobile app, you can manage your insurance and other products, request roadside assistance, file and track claims, and much. Added security when you need it most. The biggest benefit in having State Farm car insurance emergency road service coverage is the peace of mind that comes. Simply call an assistant coordinator at if you are facing an unexpected roadside emergency. State Farm Insurance is the official sponsor of the Highway Emergency Local Patrol (HELP) traveler assistance service. The funding is used. Please call us + for immediate assistance. Call. What to Expect. When you call, a service provider will be. Whatever you drive, State Farm has you covered and is ready to serve with great savings options and attentive service. Plus, your coverage can be aligned to. Optional features details and availability vary by state. Referred to as Towing and Labor in North Carolina. Roadside Assistance/Towing and Labor needs to be. You've used the service 5x in a 24 month period. That service costs what to you? $5/mth? It costs them probably about $ each time you need. Services include towing, tire and battery service, fuel delivery, and more. PROGRAM DETAILS: Members that carry emergency roadside service on their auto policy. insurance and Emergency Roadside Service (ERS) coverage. You don't have to ride solo when you have insurance from State Farm. Get in touch with Kersha. Protect your life and loved ones with State Farm® insurance in New York, NY. Your good neighbor is here to help with home, auto, life insurance, and more. reviews and 16 photos of STATE FARM EMERGENCY ROAD SERVICE "If I could leave no stars I would. I called in a tow at pm and it is now and the. With more than 20, towing and road service facilities and 10, professional locksmiths, our dispatch service will send the nearest professional to you. Get. When you add Emergency Roadside Assistance coverage to your Farm Bureau Member's Choice insurance policy, you're buying peace of mind. Our 24/7 dispatch service. Have questions? Call STATEFARMSTATEFARM · Auto & Home Insurance · Life & Health Insurance · Investment Services · Customer Care · Banking Options · Additional. As far as I know there is not a set amount. State Farm usually covers towing to the nearest repair shop (up to 50 miles). If you are in a very. From car insurance to homeowners, motorcycle, and renters coverage, Esurance will be there for you from quote to claim with lightning-fast claims and proven. With the State Farm® mobile app, you can manage your insurance and other products, request roadside assistance, file and track claims, and much more. LPT: Do not use roadside assistance through your car insurance company. Every time you do it counts as a claim and your insurance may be. Stranded on the road? Whether you're close or far from home, our friendly emergency roadside service team is ready to help you get where you need to go.

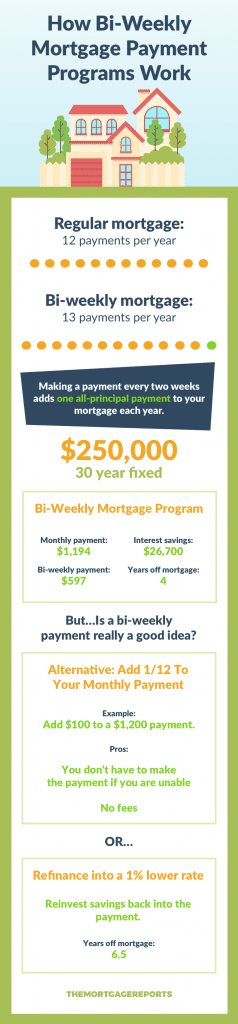

Does Paying Your Mortgage Bi Monthly Make A Difference

A biweekly mortgage is “regular” mortgage. The only difference is that you structure your payments so that, instead of making one payment at the beginning of. You can pay off your mortgage years earlier and owe less interest by dividing your monthly mortgage payments in half, and paying that amount every other week. Making biweekly mortgage payments could reduce your loan principal faster, meaning you may pay off the mortgage early. It could also reduce the interest you pay. One popular way that some homeowners & other borrowers pay down their principal more quickly is to make biweekly payments. Instead of paying one monthly payment. In effect, you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. But, as you're about to discover, you. The reason is that with the “accelerated” options, you make the equivalent of one extra monthly payment per year. Regular weekly and biweekly options do not. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the. If you make accelerated biweekly payments you can save tens of thousands in interest while also paying off your mortgage years faster! How do Bi-weekly Payments. Why the difference? With a biweekly, it takes a year before additional payments are made to your principal. Only then do you begin saving on interest. It. A biweekly mortgage is “regular” mortgage. The only difference is that you structure your payments so that, instead of making one payment at the beginning of. You can pay off your mortgage years earlier and owe less interest by dividing your monthly mortgage payments in half, and paying that amount every other week. Making biweekly mortgage payments could reduce your loan principal faster, meaning you may pay off the mortgage early. It could also reduce the interest you pay. One popular way that some homeowners & other borrowers pay down their principal more quickly is to make biweekly payments. Instead of paying one monthly payment. In effect, you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. But, as you're about to discover, you. The reason is that with the “accelerated” options, you make the equivalent of one extra monthly payment per year. Regular weekly and biweekly options do not. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the. If you make accelerated biweekly payments you can save tens of thousands in interest while also paying off your mortgage years faster! How do Bi-weekly Payments. Why the difference? With a biweekly, it takes a year before additional payments are made to your principal. Only then do you begin saving on interest. It.

Tens of thousands of dollars can be saved by making bi-weekly mortgage payments and enables the homeowner to pay off the mortgage almost eight years early. How does a biweekly mortgage payment work? Most homeowners make their mortgage payments once a month. But if you begrudge every penny of interest you pay your. The two methods of payment can make a great deal of difference in the ultimate total of payments made, and the total interest paid. Bi-weekly payments (if. You could save thousands on your mortgage by making a simple change to the way you pay. In this article, we'll explore how switching to biweekly payments. At least here, interest is calculated daily and does not change until a full payment is made. Partial payments have no effect on it. Biweekly mortgage payments are straightforward: Instead of making one full monthly payment, you pay half your monthly mortgage amount every two weeks. By making half of your regular monthly payment every two weeks, biweekly payments accelerate the repayment of your mortgage. You will have paid the equivalent. Paying your mortgage biweekly can reduce your principal balance faster and cut your total interest costs. Find out if this strategy is right for you. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Biweekly payments accelerate your mortgage payoff. Make bi-weekly loan payments instead of monthly to pay more toward your principal without impacting your budget. Home equity borrowing options can finance. What is the difference with a bi-weekly payment plan? With a bi-weekly mortgage payment plan, you make half of your usual mortgage payment every two weeks. Understanding mortgage payments When you make more frequent mortgage payments, you are paying more towards your principal, thus, saving you thousands in. Why the difference? With a biweekly, it takes a year before additional payments are made to your principal. Only then do you begin saving on interest. It. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Biweekly payments accelerate your mortgage payoff. Put simply, you'll pay the bank less interest and own your home sooner, if that's your goal. This can be especially useful if mortgage rates are high, but less. The two methods of payment can make a great deal of difference in the ultimate total of payments made, and the total interest paid. Bi-weekly payments (if. If you make accelerated biweekly payments you can save tens of thousands in interest while also paying off your mortgage years faster! How do Bi-weekly Payments. By rounding up your monthly principal and interest payment or by considering biweekly payments rather than monthly, you may be able to save on the amount of. A biweekly mortgage is “regular” mortgage. The only difference is that you structure your payments so that, instead of making one payment at the beginning of. See the difference biweekly mortgage payments can make. Bi-weekly payments accelerate your mortgage payoff by paying half of your normal monthly payment every.

Why Do They Raise Interest Rates

In response, the Federal Reserve started increasing interest rates to cool the pace of rising prices, hiking its benchmark rate 11 times between March and. The Fed is keeping the rate steady for now, in response to continued high inflation. Some were even speculating that they may hike the rate, though that. Supply and Demand. An increase in the demand for money or credit will raise interest rates, while a decrease in the demand for credit will decrease them. Banks can then use the reserves that they have obtained at lower rates to offer loans at lower interest rates to businesses and consumers. The cheaper credit in. Supply and Demand. An increase in the demand for money or credit will raise interest rates, while a decrease in the demand for credit will decrease them. It does this by setting interest rates, influencing the supply of money in the economy, and, in recent years, making trillions of dollars in asset purchases to. It raises rates when the economy is too hot, threatening to raise inflation. It lowers rates when the economy is sluggish to boost activity to a healthy level. Increases in interest rates increase the amount people with variable payments spend on their mortgage each month. This reduces the amount of money they have for. The Fed has repeatedly raised rates in an effort to corral rampant inflation that has reached year highs. Higher interest rates may help curb soaring prices. In response, the Federal Reserve started increasing interest rates to cool the pace of rising prices, hiking its benchmark rate 11 times between March and. The Fed is keeping the rate steady for now, in response to continued high inflation. Some were even speculating that they may hike the rate, though that. Supply and Demand. An increase in the demand for money or credit will raise interest rates, while a decrease in the demand for credit will decrease them. Banks can then use the reserves that they have obtained at lower rates to offer loans at lower interest rates to businesses and consumers. The cheaper credit in. Supply and Demand. An increase in the demand for money or credit will raise interest rates, while a decrease in the demand for credit will decrease them. It does this by setting interest rates, influencing the supply of money in the economy, and, in recent years, making trillions of dollars in asset purchases to. It raises rates when the economy is too hot, threatening to raise inflation. It lowers rates when the economy is sluggish to boost activity to a healthy level. Increases in interest rates increase the amount people with variable payments spend on their mortgage each month. This reduces the amount of money they have for. The Fed has repeatedly raised rates in an effort to corral rampant inflation that has reached year highs. Higher interest rates may help curb soaring prices.

For the five central banks that have permanent swap lines with the Fed—Canada, England, the Eurozone, Japan, and Switzerland—the Fed lowered its interest rate. By rising interest rates when inflation is high, central banks influence both the amount and cost of loans that people and companies can get. They influence. Interest rates respond and change due to economic growth, fiscal, and monetary policy. Let's consider the biggest factor that influences interest rates. The Fed has repeatedly raised rates in an effort to corral rampant inflation that has reached year highs. Higher interest rates may help curb soaring prices. Raising rates may help slow spending by increasing the cost of borrowing, potentially reducing economic activity to slow inflation down. Raising rates may also. Raising rates may help slow spending by increasing the cost of borrowing, potentially reducing economic activity to slow inflation down. Raising rates may also. Red arrow: To implement the FOMC's policy change, the Fed would increase the administered rates—interest on reserve balances rate, overnight reverse repurchase. Have you ever wondered what an interest rate hike or cut means for your personal finances? When the Federal Reserve changes rates, it can influence how much. If inflation is rising, the Fed might raise interest rates. Learn how this might impact your investments. Since the Fed began raising rates in , the Fed has raised rates to to %, making these hikes the fastest cycle in history. TIP. What should you do. The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates. If inflation is rising, the Fed might raise interest rates. Learn how this might impact your investments. In other words, the Fed uses its tools to ensure that market interest rates, especially the federal funds rate, move in the direction of the new target range. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. Similarly, the Federal Reserve can increase. Why? Inflation is growing, which makes things cost more. To slow this inflation and strengthen the economy, the U.S. central bank, the Federal Reserve (the “. Answer: Many investors understand some of the basic effects that rising interest rates have. Higher rates ultimately benefit savers, because rates on savings. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight. The interest rate we control is the cash rate, which is the rate that banks charge each other to borrow overnight. Now this interest rate influences other. The Fed began to raise rates again in March , taking them from % to % in July Eurozone (European Central Bank). At its 12 September. If the central bank tightens, for example, borrowing costs rise, consumers are less likely to buy things they would normally finance—such as houses or cars—and.

Gold Etfd

Grantor trusts: Like physical gold, gold ETFs that hold physical gold are generally structured as grantor trusts and taxed as collectibles. For example, capital. A Gold Fund is a type of Mutual Fund that primarily invests in a Gold Exchange Traded Fund (Gold ETF) or equity stocks of companies engaged primarily in mining. With 35 ETFs traded on the U.S. markets, Gold ETFs have total assets under management of $B. The average expense ratio is %. Gold ETFs can be found in. These gold ETFs provide investors with numerous ways to play the metal, from direct exposure to stock-related angles, on the cheap. Gold Rated ETFs ; Foreign Large Growth · High Yield Muni · Muni National Interm · Diversified Emerging Mkts ; — · — · — · —. First, the underlying asset is always gold. Second, while they are physically-backed, you will not own actual gold from Gold ETFs – when you sell, for example. But gold-backed exchange traded funds (ETFs) offer a high degree of flexibility, transparency, and accessibility to the gold market with the cost-effective. One of the key benefits of investing in Gold ETFs and Silver ETFs is that they offer a convenient and cost-effective way to invest in precious metals. The. Investors can access gold in many different ways — from bars and coins to mutual funds and futures contracts. But gold-backed exchange traded funds (ETFs). Grantor trusts: Like physical gold, gold ETFs that hold physical gold are generally structured as grantor trusts and taxed as collectibles. For example, capital. A Gold Fund is a type of Mutual Fund that primarily invests in a Gold Exchange Traded Fund (Gold ETF) or equity stocks of companies engaged primarily in mining. With 35 ETFs traded on the U.S. markets, Gold ETFs have total assets under management of $B. The average expense ratio is %. Gold ETFs can be found in. These gold ETFs provide investors with numerous ways to play the metal, from direct exposure to stock-related angles, on the cheap. Gold Rated ETFs ; Foreign Large Growth · High Yield Muni · Muni National Interm · Diversified Emerging Mkts ; — · — · — · —. First, the underlying asset is always gold. Second, while they are physically-backed, you will not own actual gold from Gold ETFs – when you sell, for example. But gold-backed exchange traded funds (ETFs) offer a high degree of flexibility, transparency, and accessibility to the gold market with the cost-effective. One of the key benefits of investing in Gold ETFs and Silver ETFs is that they offer a convenient and cost-effective way to invest in precious metals. The. Investors can access gold in many different ways — from bars and coins to mutual funds and futures contracts. But gold-backed exchange traded funds (ETFs).

Click to see more information on Leveraged Gold ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. OUNZ - Overview, Holdings & Performance. VanEck Merk Gold ETF offers an opportunity to invest in gold through the convenience of an ETF with the option to. Compare the top gold ETFs on statistics like AUM and expense ratio. Click here to see a detailed comparison of BAR, GLD, GLDM, IAU, PHYS, and SGOL. Gold ETFs · Top ETFs in this segment · Just published in Gold · Recently launched ETFs · Related indexes by ICE · Other popular segments · Latest news about Gold. Diversify your investment portfolio and get direct exposure to the price of gold bullion without having the hassle of buying and storing the precious metal. Global X Physical Gold (GOLD) offers a low-cost and secure way to access physical gold via the stock exchange. Gold ETF. A Gold ETF is an exchange-traded fund (ETF) that aims to track the domestic physical gold price. They are passive investment instruments that are. The main benefit of a gold ETF is accessibility and flexibility. Investors can easily access the asset through a brokerage account. Gold exchange-traded products are exchange-traded funds (ETFs), closed-end funds (CEFs) and exchange-traded notes (ETNs) that are used to own gold as an. First, the underlying asset is always gold. Second, while they are physically-backed, you will not own actual gold from Gold ETFs – when you sell, for example. SPDR® Gold MiniShares (NYSE Arca: GLDM) offers investors one of the lowest available expense ratios for a U.S. listed physically gold-backed ETF. GLDM® also has. The Fund defines responsibly sourced gold as London Good Delivery gold bullion bars that were refined on or after January 1, The story behind how and why the gold ETF came about and the obstacles that had to be overcome to get there. This article reveals what really happened. Gold ETFs ETFs (exchange-traded funds) are commodity funds that act like individual stocks and are traded through online brokers and broker-dealers. Gold-. Ways to add gold to your investment portfolio · Gold coins and bars · Gold mining stocks · Gold ETFs and other exchange-traded products · Gold futures and options. Gold ETFs offer access to gold, a hedge against inflation, and additional diversification without having to buy and store the physical commodity. Seeks to replicate the performance of the price of gold bullion, less fees and expenses. How do Gold ETFs work? Gold ETFs are purchased through stockbrokers who use the funds you've invested to purchase gold bullion (gold that is officially. For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that. Click to see more information on Leveraged Gold ETFs including historical performance, dividends, holdings, expense ratios, technicals and more.